October Market Update

Economic Overview:

War threats increasing as Israel fights off Hamas and Ukraine defends Russian Invasions.

Nonfarm payrolls increased by 336k for the month, better than the Dow Jones consensus estimate of 170k..

The unemployment rate is 3.8%, compared to the forecast for 3.7%, Leisure and hospitality led job growth, followed by government and health care.

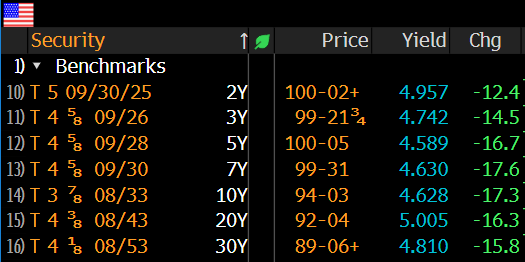

Higher interest rates for longer seems to be the theme of the fall thus far.

The 10-year Treasury yield, which serves as a benchmark for mortgage rates and as an investor confidence barometer, on Tuesday surged to its highest level since 2007. The yield was up to 4.81, after climbing to 4.8% earlier in the week. The 30-year Treasury yield rose as high 5.05%, also the highest since 2007.

While the economy will likely avoid a recession in the near term, PwC expects US growth will likely slow next year. PwC’s baseline expectation is for real GDP growth to top 2% in 2023, but then slip to about 1.5% in 2024.

The US economy has shown remarkable resilience over the last year. Consumer spending has held up in the face of higher prices and interest rates, while businesses have trudged through uncertainty without the economy falling into recession.

Trends:

New York City is on pace to see fewer than $10B in commercial real estate deals, according to Avison Young figures, a shadow of the historical 10-year average of $34.2B. The last time total investment sales were below $10B in New York City was in 2009, per the brokerage.

Between July and September, just $2.2B worth of commercial properties changed hands, a 41% drop below the average of the four previous quarters and a 21% fall from Q2, according to Avison Young data.

Industrial is the safest asset class among the commercial real estate sectors, according to some CRE analysts, and the announcement this week that KKR has completed the sale of over 5 million square feet of industrial warehouse and distribution properties for a total aggregate value of over $560 million confirms its value.

The delinquency rate of commercial mortgages on office properties that had been securitized into CMBS spiked to 5.6% by loan balance in September, having more than tripled so far this year, from a delinquency rate of 1.6% in December, according to Trepp which tracks and analyzes CMBS.

The cycle during the Financial Crisis, when delinquency rates eventually exceeded 10% in 2012 and 2013, started more slowly and proceeded more slowly than this cycle.

The debt markets have also seen pockets of optimism. Issuance remains confined to higher rated credits and has largely favored secured borrowing.

Defeasance Market:

The cost of defeasance continues to be the lowest it has been in years. Because of higher rates and the inverted yield curve the defeasance “premiums” are actually negative in many cases.

Transactions getting done across the country continue to be driven by mostly select property types; Multifamily, Self-Storage, Retail, Industrial as well as some select Office assets.

Author