November 2024 Market Update

Economic Overview:

- According to Goldman Sachs, The S&P 500 is still projected to climb some 9% to 6,300 in the next 12 months. Their researchers forecast growth in earnings-per-share of 11% in 2025 and 7% the year after, though they point out that those estimates may change as more about the new administration’s policy agenda is revealed.

- Investors have since re-engaged some of the trades that were successful after the 2016 presidential race, such as buying financials, small caps, technology, and energy stocks, also according to Goldman Sachs.

- The resolution of political uncertainty is a key, near-term driver for stocks and tends to drive strong year-end returns following a presidential election. The S&P 500 index has historically generated a median return of 4% between Election Day in November and calendar year-end. Combined with the recent resilience in economic growth data and the expectation for more rate cuts by the Federal Reserve, the near-term outlook for US equities is “healthy,” Goldman Sachs writes.

Commercial Real Estate Market Overview:

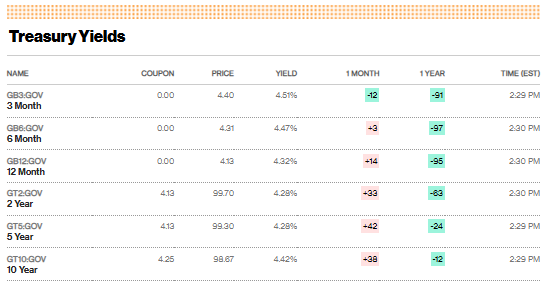

- On November 7th, the Fed loosened monetary policy further with a widely expected 25 bps cut, bringing target policy rates to a range of 4.5% to 4.75%. The Fed has now cut rates by a cumulative 75 bps from their peak (terminal) rate, demonstrating their strong commitment towards achieving both sides of its mandate. This per Cushman and Wakefield.

- Yield Curve Normalization Implications for CRE: As the yield curve continues to flatten and eventually un-inverts, capital will naturally and gradually start to shift out of the short-end of the curve and into longer-dated instruments, in order to achieve better yield. This should ignite more demand for longer-term investments such as Commercial Real Estate, this underscores the Cushman view that the CRE capital markets will continue to gain traction as the yield curve flattens and un-inverts.

- CRE has weathered a challenging era, but the outlook for the near future is more positive than it’s been since the end of the COVID-19 pandemic. The economy will not set any growth records, but it appears to have avoided a recession and may, in fact, get the soft landing CRE professionals hoped for. This has CRE executives feeling optimistic. Recently established CRE trends including the growth of the digital economy, the work-from-home trend, the greening of CRE, and the rehabbing and repurposing of retail space will continue. This according to CBRE.

Defeasance Market:

- The market continues to trade sidewaysbe, much of the defeasance activity continues to be centered around asset sales as well as refinancing on notes with less than 2 years in duration. Lower rates across the board is resulting in more activity in all asset classes.

- The majority of the asset classes being considered includes; Retail, Hospitality, NNN, Industrial as well as some smaller balance notes (i.e. less than 5 million). Retail continues to see much of the activity as these assets are relatively quick to reprice.

Author