June 2024 Market Update

Economic Overview:

The Federal Reserve held interest rates steady at their current range of 5.25% to 5.5%, but revised its outlook for rate cuts to just one in 2024. Central bank policymakers noted that there has been “modest further progress” toward its 2% inflation objective.Federal Reserve Chair Jerome Powell noted at the press conference that the central bank does not yet have the confidence to cut rates, even as inflation has eased from its peak levels. Federal Reserve Chair Jerome Powell said the central bank does not yet have the confidence to start lowering interest rates, even after May’s consumer price index on Wednesday came in cooler than expected.

“We see today’s report as progress and as, you know, building confidence,” Powell said. “But we don’t see ourselves as having the confidence that would warrant beginning to loosen policy at this time.”

The Federal Reserve’s restrictive stance on monetary policy is having the effect on inflation central bankers had hoped to see, Fed Chair Jerome Powell said Wednesday afternoon. However, he did say there is a growing economy and strong labor market. While inflation ran high, he noted that the pace of price increases has come down “significantly.”

Federal Reserve Chair Jerome Powell said no one on the committee has interest rate hikes in their base case. “Not to eliminate the possibility of hikes, but no one has that as their base case,” Powell said. “No one on the committee does.”Federal Reserve Chair Jerome Powell said it is unclear why the sentiment of everyday Americans is so sour on the economy.“I don’t think anyone … has a definitive answer why people are not as happy about the economy as they might be,” he said.

Defeasance Market:

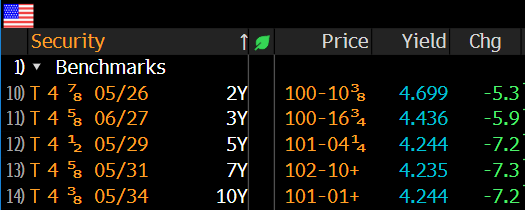

- The market continues to trend sideways to down, much of the defeasance activity continues to be centered around asset sales as well as refinancing on notes with less than 2 years in duration, this is to be expected given higher rates and the inverted yield curve. With current rates it is much more challanging for deals to pencil.

- The Lionshare of the asset classes being considered includes; Retail, Hospitality, NNN, Industrial as well as some smaller balance notes (i.e. less than 5 million).

Author