July 2024 Market Update

Economic Overview:

The June 2024 Consumer Price Index (CPI) fell by 0.1% month-over-month (MoM) and rose by 3.0% year-over-year (YoY).

- Inflation eased across the board; JP Morgan saw this as a welcome move with lower shelter price pressures (inflation coming from the housing market). There were also saw favorable declines in gasoline and airfares prices.

- In the JP Morgan view, this is a welcome report for the Federal Reserve (Fed) that should further increase confidence that inflation is on its way back to the 2% target. June’s inflation report along with last week’s jobs report supports the view that we are getting closer to a rate cut, perhaps as soon as September.Commercial

Real Estate Market Overview: - Commercial real estate investing has long been seen as a source of dependable returns and dividends, but legendary investor Charlie Munger, before his passing, issued a warning in 2024 that points to dramatic change.

- “A lot of real estate isn’t so good anymore,” Munger, Warren Buffett’s close friend, told the Financial Times. “We have a lot of troubled office buildings, a lot of troubled shopping centers, a lot of troubled other properties. There’s a lot of soft spots out there.”

- There is a growing intensity of distress commercial real estate markets across the US, which face higher interest rates and softer demand. Valuations of commercial space, especially downtown offices, have also fallen dramatically, leading to fewer transactions. Office foreclosures in the first half of 2024 have already exceeded the total number recorded in 2023, CBRE reported, fueled primarily by rising vacancy and upcoming debt maturities.

Defeasance Market:

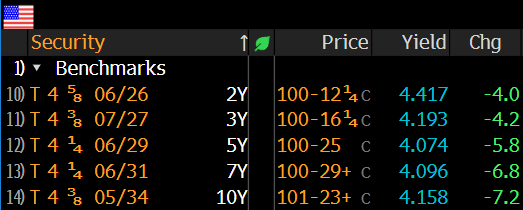

- The market continues to trend sideways to down, much of the defeasance activity continues to be centered around asset sales as well as refinancing on notes with less than 1-2 years in duration, this is to be expected given higher rates and the inverted yield curve. With current rates it is much more challenging for deals to pencil.

- The majority of the asset classes being considered includes; Retail, Hospitality, NNN, Industrial as well as some smaller balance notes (i.e. less than 5 million).

Author