December 2024 Market Update

Economic Overview:

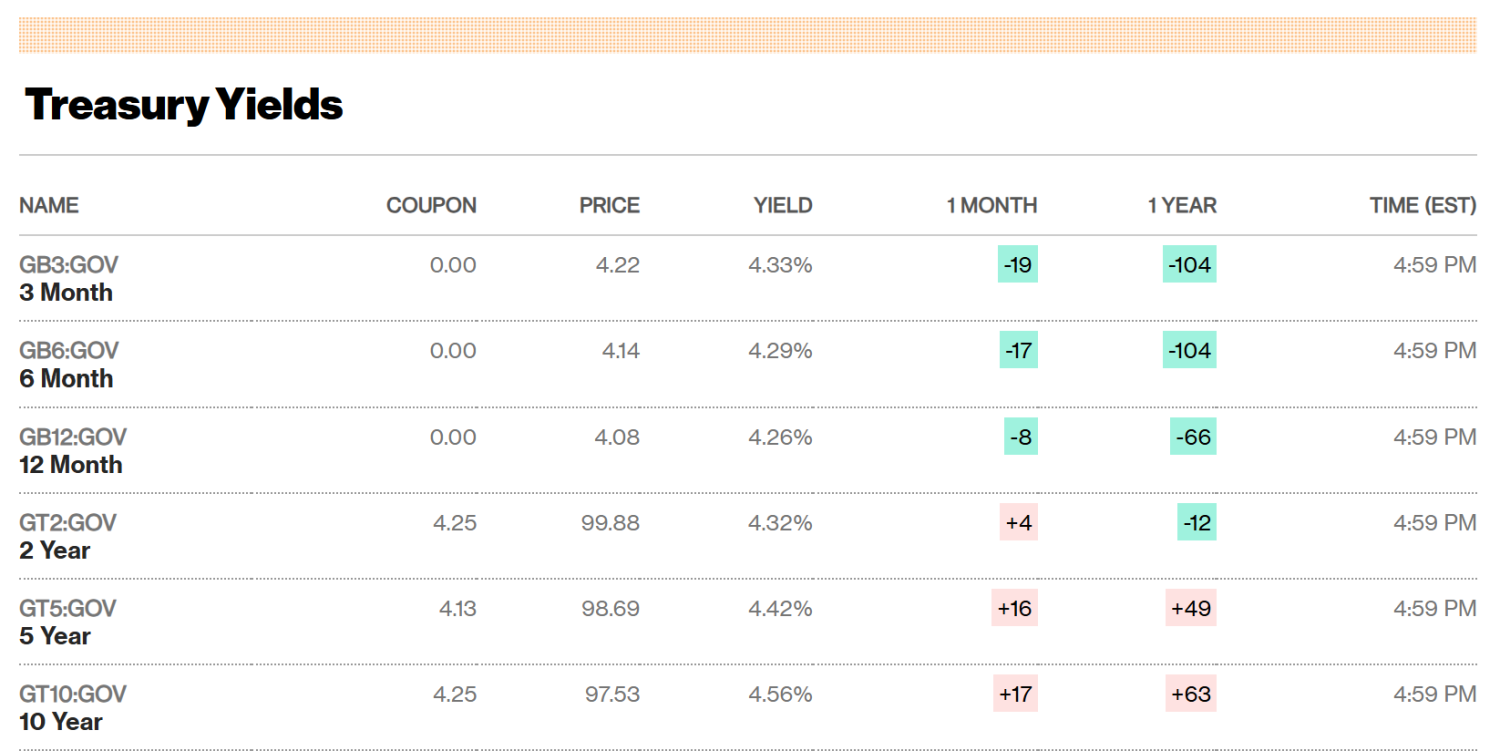

- The Federal Reserve cut interest rates by a quarter point this week, bringing the target range to 4.25% to 4.5%. The central bank revised its outlook for rate cuts in 2025, however, indicating that there will be two reductions. That’s down from the four forecast in September.

- Fed Chair Jerome Powell said that the central bank would be looking for progress on inflation, noting, “We have been moving sideways on 12-month inflation.”

- Chair Powell stated “We understand very well that prices went up by a great deal, and people really feel that, and its prices of food and transportation and heating your home and things like that. So there’s tremendous pain in that burst of inflation that was very global, Now we have inflation itself is way down – but people continue to feel high prices”

Commercial Real Estate Market Overview:

- The U.S. economy is growing robustly. It’s time to retire the recession predictions; the economic fundamentals remain strong going into 2025. This is according to Cushman and Wakefield.

- For CRE, the worst of the supply-demand imbalance is behind us. An inflection point is nearing, even for office, which is undersupplying the product occupiers want the most.

- Also, according to Cushman and Wakefield, there are downside risks to the outlook, but that is always the case. Prospects are good that the tide is finally turning for the CRE sector.

- The U.S. economy looks set for above-average growth in 2025, driven by consumer spending. This growth and potentially persistent inflation may mean interest rates will stay higher for longer, according to CBRE’s 2025 U.S. Real Estate Market Outlook.

- CBRE foresees several positive developments in 2025, including a modest increase in commercial real estate investment volume, a topping out of vacancy in the office market, and rising occupancy and rents in the multifamily sector despite robust new supply.

Defeasance Market:

- The defeasance market continues to be tight, much of the defeasance activity continues to be centered around asset sales as well as refinancing on notes with less than 2 years in duration. Stubborn interest rates continue to provide a landscape where some transactions are getting done but at a slower rate that the last few years.

- The majority of the asset classes being considered includes: Retail, Hospitality, NNN, Industrial as well as some smaller balance notes (i.e. less than 5 million). Retail and Self storage continue to be the most active asset types.

Author