August 2024 Market Update

Economic Overview:

- BMO Capital Markets chief investment strategist Brian Belski argues investors will kick themselves if they do not buy this market pullback. He continued on CNBC “People are going to hate to hear this, but this is pretty normal and the markets are headed into ‘normalization’.

- Thomas Lee, Managing Partner of FS Insight, explained that the events of this past week will likely be viewed as a growth scare. The VIX (30 day expected market volatility), it was 60 a couple of days ago and is 24 now, this is a sign that fear is ebbing.

- Ernst & Young continues to see inflation easing with headline and core CPI inflation at 2.8% and 3.0% y/y in Q4 2024, they also anticipate the Fed’s favored inflation gauge, the deflator for personal consumption expenditures (PCE), to end the year around 2.5% y/y.

Commercial Real Estate Market Overview:

- Commercial real estate (CRE) is navigating several challenges, ranging from a looming maturity wall requiring much of the sector to refinance at higher interest rates to a deterioration in overall market fundamentals, including moderating net operating income (NOI), rising vacancies and declining valuations.

- According to CBRE, there is an increased chance that the U.S. will avoid a recession and achieve a soft economic landing in 2024, but economic growth is slowing and downside risks are elevated.

- Also per CBRE, the following CRE trends are likely to continue and or play out:

- Commercial real estate investment activity likely will begin to pick up in the second half of 2024,The normalization of hybrid working arrangements will continue to limit the growth of office demand.

- Retail real estate fundamentals are expected to remain strong due to the scarcity of new construction deliveries over the past decade.

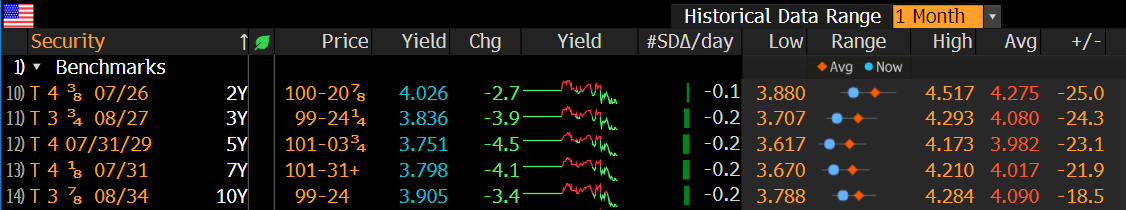

Defeasance Market:

- The market continues to move sideways, much of the defeasance activity continues to be centered around asset sales as well as refinancing on notes with less than 1-2 years in duration. This will likely continue until lower rates are reflected in lending rates.

- The majority of the asset classes being considered includes; Retail, Hospitality, NNN, Industrial as well as some smaller balance notes (i.e. less than 5 million).

Author