January 2024 Market Update

Economic Overview:

According to Forbes, The Federal Reserve did an excellent job bringing down inflation in 2023 while avoiding a U.S. economic recession. Investors now anticipate the Federal Open Market Committee, or FOMC, will pivot from rate hikes to rate cuts by mid-2024. However, Fed officials have repeatedly cautioned that the FOMC’s battle with inflation still has a long way to go. If the Fed pivots to rate cuts too soon, inflation could easily rebound in 2024. Even if the Fed can navigate a soft landing for the economy in 2024, economists still expect inflation to remain above the Fed’s long-term 2% inflation target.

J.P. Morgan’s Global Investment Strategists believe that while the U.S. economy could see a growth slowdown in the first half of 2024 it will likely avoid a recession. Higher bond yields and reasonable stock valuations mean that forward-looking returns seem more promising than they have been in more than a decade. In the U.S., growth should slow to 1.9% year over year in 2024 and 1.4% in 2025, down from an estimated 2.4% in 2023, as higher interest rates and tighter monetary policy work their way through the financial system.

Trends:

It was an uphill battle for Commercial Real estate in 2023. Higher interest rates, elevated inflation and the threat of a recession all contributed to a year of turbulence and uncertainty. Despite the challenges, the industry demonstrated bright spots of resilience and adaptability. The overall outlook for commercial real estate in 2024 is muted, Per Moody’s Analytics. Across all sectors, there will be a continued recalibration of sorts, this includes office, multifamily, industrial, and retail properties.

CBRE expects an economic slowdown in the U.S. this year that will impact commercial real estate with bank lending remaining tight throughout 2024, investment volume decreasing 5 percent, cap rates expanding and property values declining. There is an increased chance that the U.S. will avoid a recession and achieve a soft economic landing in 2024, but economic growth will slow and downside risks are elevated.

Also, according to CBRE, Commercial real estate investment activity likely will begin to pick up in the second half of 2024. Retail real estate fundamentals are expected to remain strong due to the scarcity of new construction deliveries over the past decade. The industrial market is expected to remain healthy, with net absorption on par with 2023 levels. The biggest wave of new apartment supply in decades will temper rent growth and improve affordability for renters in 2024.

Defeasance Market:

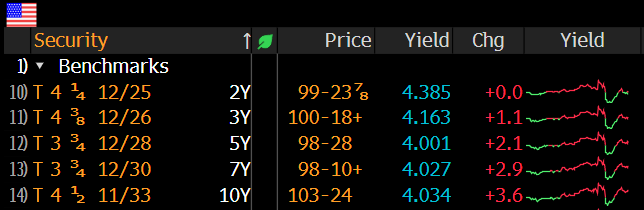

The cost of defeasance continues to trade within a relatively tight range based on the duration and rate of the underlying note, this is because of higher rates and the inverted yield curve.

Although the number of transactions in 2023 was significantly lower than 2022, a good number of deals were still done, driven by sales and refinancing is selective situations and asset classes. These include Self-Storage, Retail, Multifamily and NNN.

Author