April Market Update

Economic Overview:

The US economy has performed better than expected through the first part of the year, with 1Q GDP growth up an estimated 3.25%. This has largely been driven by consumer spending – which drives nearly two thirds of economic activity – amid a backdrop of rising wages, moderating inflation and $1.2 trillion of remaining “excess savings.” Despite the recent resilience, JP Morgan continues to anticipate slowing economic growth in the coming quarters, with the cumulative effects of higher interest rates and tighter credit conditions to gradually temper demand. This according to J.M. Morgan.

Also according to J.P. Morgan, to Turning to inflation, headline CPI saw a big step down in March to 5% from 6% while core CPI ticked up to 5.6% from 5.5%. The headline number was driven by a stabilization in food prices and a 3.5% month on month decline in energy prices. The welcome reading on food prices was driven by food at home, particularly meat and fruits and vegetables. Prices for food away from home continued rising given stronger trends for dining out. In energy, gasoline prices dropped 4.6% from February while household energy prices fell 2.3%, one of the larger declines on record.

Investors who have historically made multifamily sales a consistent, reliable real estate choice are pulling back. In the first quarter of 2023, they purchased $14 billion of apartment buildings, according to a preliminary report by CoStar Group that was reported in the Wall Street Journal. But that huge investment represented a 74% drop from the same quarter in the prior year, according to the WSJ. Equally significant is that this is the largest annual sales decline since early 2009 when there was a 77% pullback due to the Great Recession.

Trends:

It is in the details, strength in commercial real estate largely depends on asset class. As of the end of Q1 2023, national office space vacancy rate is approximately 19%, while the industrial space vacancy rate is less than 3%, this according to CBRE.

According to Cushman and Wakefield, tough economic headwinds such as high interest and inflation rates will probably make the climate more difficult, at least in the near term. Looking at building projects for additional industrial space, the under-construction pipeline continued to decline modestly (-3.0% since year-end 2022) as completions outpaced construction starts. And construction starts are anticipated to further slow as the year progresses under the current economic climate.

Defeasance Market:

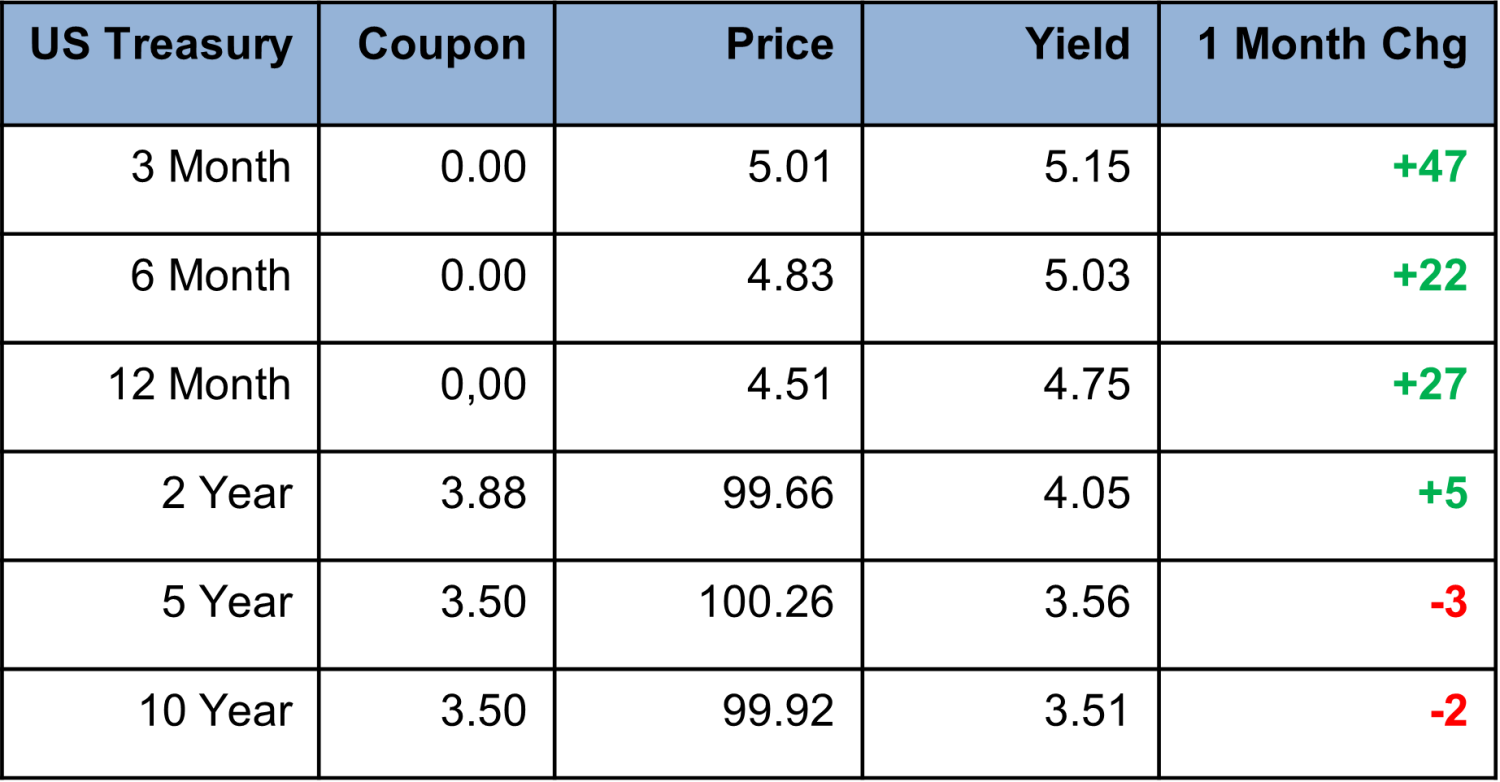

As in the past few months, much of the defeasance market continues to be driven by the inverted Yield Curve, the cost of defeasance is still the lowest it has been in years. The challenge thus far for 2023 is the ability of owners to pencil new projects. There are a number of transactions getting done across the country continues to be driven by mostly select property types; Multifamily, Self-Storage, Industrial and NNN.

Author